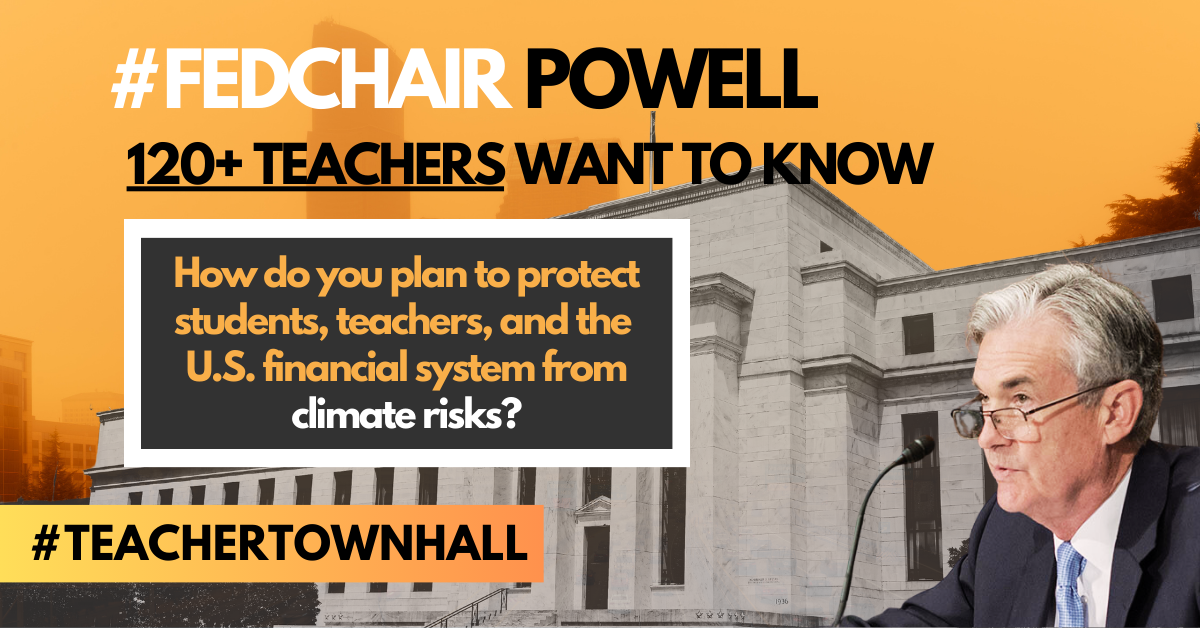

Positive Money US sends letter on behalf of 120+ educators with questions Chair Powell must answer.

WASHINGTON, D.C. – Over 120 educators joined forces in submitting a letter to Federal Reserve Chair Jerome Powell demanding answers to questions about growing climate change-related financial risks at his educator town hall. The letter submitted by Positive Money US on behalf of the signers coincides with individual questions submitted for the Federal Reserve’s Conversation with the Chair: A Teacher Town Hall Meeting at 4pm ET today. The action is part of continued efforts targeting the Federal Reserve and Chair Jerome Powell, who will be responding to questions during the nationwide webcast, on climate risks.

In the letter, educators are demanding answers from Chair Powell and pressed the Federal Reserve to immediately act on escalating climate-related financial risks that threaten Americans’ retirement savings and pensions, students’ education outcomes and future, and the broader economy.

Debra Rowe, President of the U.S. Partnership for Education for Sustainable Development, questioned the Federal Reserve’s lack of action on growing climate risks in her submission: “In 2008, many of us saw our pensions shrink because of Wall Street’s recklessness and the subprime mortgage crisis. Now banks are doing the same thing with fossil fuels. Despite all the financial risks, U.S. banks are pouring billions into dirty energy every year. Why are you not protecting us and our economy by taking proactive action to rein in banks’ fossil fuel financing?”

Akiksha Chatterji, Lead Campaigner at Positive Money US said, “Chair Powell and the Federal Reserve are failing to take any meaningful action to rein in banks’ risky and excessive fossil fuel financing that is driving escalating climate and economic chaos. Teachers’ pensions and their livelihoods and futures are all being gambled with so that polluters and their financiers can make a quick buck. Chair Powell should step up and address the questions raised by educators from across the country who are rightly concerned about the impact of climate change on our economy and importantly on students’ health, safety and futures.“

The letter signed by over 120 educators warned of the current climate chaos realties already disrupting their students and families lives, and urged the Chair Powell to address climate financial risks at the town hall by answering the following questions:

- Why aren’t you protecting us and our economy by taking proactive action to rein in banks’ fossil fuel expansion financing?

- Why aren’t you taking action to address the risks small to mid-sized banks are facing from climate change and the financing of fossil fuels?

- Why aren’t you taking steps to protect our students’ economic futures by reining in fossil fuel expansion financing which contributes to climate change and financial instability?

- Are you taking any steps to understand how more frequent and severe climate-related disasters and chronic weather patterns are now and will in the future impact the price of everyday goods and drive inflation?

The letter concluded by pressing the Fed ‘to mitigate climate financial risks to protect our students and their education and futures, to protect teachers and their path to retirement, and to protect the overall safety and soundness of the U.S. financial system.’ The full letter is available here. Last week, Senator Markey (D-MA) and Rep. Pressley (D-MA-07) sent a letter to Chair Powell urging him and the Federal Reserve to address climate-related financial risks.

More frequent extreme weather events, primarily driven by fossil fuels, impacts schools and students across the country. School buildings are being destroyed or forced to close in response to extreme heat, flooding, hurricanes and other disasters, which impacts students’ learning and mental health. A Government Accountability Office report found that “Over one-half of public school districts [are] in counties that experienced presidentially-declared major disasters from 2017 to 2019. These school districts included over two-thirds of all students across the country.” And, a study published in the National Bureau of Economic Research found that students in high temperature areas have worse learning outcomes based on results for tests such as the PSAT. Existing injustices mean that extreme weather hits low-income communities of color first and worst, including schools in these communities.

Most of the losses from a fossil fuelled financial crisis would be borne by ordinary people, including educators, through pensions, investment funds and share holdings. Unfortunately, millions of dollars of workers’ savings are propping up the fossil fuel industry, yet a recent report found that U.S. public pensions have lost at least $21 billion due to their investments in fossil fuels.

Compared to global peers, Chair Powell and the Fed have been laggards in addressing systemic climate financial risks, putting workers, businesses, and the economy at risk. The European Central Bank (ECB) is set to institute new climate transition plan reviews, which allow the central bank to increase capital requirements for banks that are poorly prepared or at high risk. Recently, ECB Board Member Frank Elderson said that “central banks and supervisors now know that climate-related risks are squarely within their mandate because they translate into financial risk. We are making progress, but we are going too slow. We have to go faster. We have to do more. We have to pull out all the stops. Those that make the rules and those that follow them. Those that pollute, and those that finance those that pollute. And those that supervise those that finance those that pollute. All of us.”