blog page

Why Can We Fund Wars but Not the Public Good?

November 20, 2023

In October, Treasury Secretary Janet Yellen said that the U.S. can “absolutely” afford to financially support both Israel and Ukraine in their respective war efforts. Why is it the case that the U.S. can always afford to spend on war and the destruction

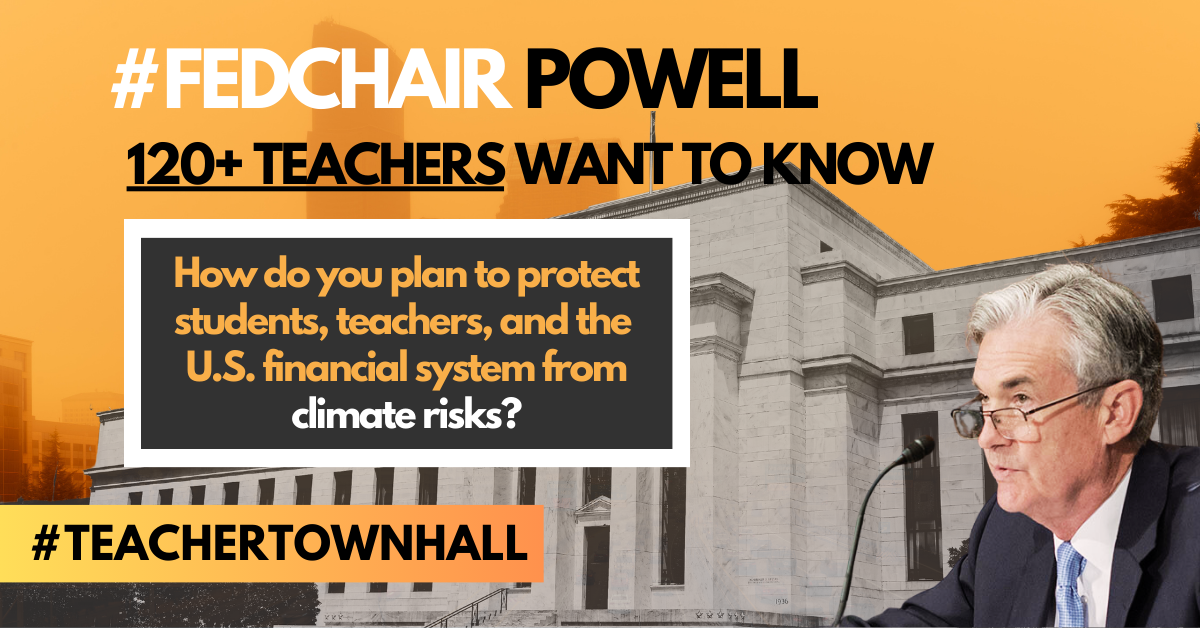

New Letter from Educators Demands Answers from Chair Powell on Climate Risk

September 28, 2023

Positive Money US sends letter on behalf of 120+ educators with questions Chair Powell must answer. WASHINGTON, D.C. – Over 120 educators joined forces in submitting a letter to Federal Reserve Chair Jerome Powell demanding answers to

Fed Pauses Rate Hikes: Positive Money Response

June 14, 2023

Washington D.C. — The Federal Reserve has decided to pause interest rate hikes for June, today’s Federal Open Market Committee meeting confirms. The Fed has raised rates ten consecutive times over the last fourteen months, pushing the benchmark

Why We Should #MintTheCoin for People and Planet

June 6, 2023

The self-imposed debt ceiling is the true gimmick that is proving to be extremely irresponsible and is causing far more issues than it is resolving. Minting the coin would entirely diffuse this contrived crisis. It’s the better option for people,

Climate Denial Is Alive at the Fed. We Need the Fossil Free Finance Act.

May 24, 2023

Banks’ destructive lending decisions are threatening the habitability of our planet and exposing all of us to higher risk from financial meltdowns. The Fed is supposed to guard against this, and serve the public interest. It’s time it stepped up to

Recent Banking Crises Reinforce the Need for a Public Banking System

March 24, 2023

The recent banking crises reveal major issues with the rules that banks have to follow in the US, and forces us to ask: what is banking for and how can it best serve society? It’s time we start treating money and payment systems as the public good they

Fed Chair Powell Grilled on Interest Rate Hikes: Positive Money Response

March 8, 2023

Washington, D.C — This week, Federal Reserve Chair Powell testified before Congress to discuss the Fed’s latest semiannual “Monetary Policy Report.” The report and Chair Powell’s testimony confirmed the Fed’s commitment to continued

FED URGED TO STEP UP ON CLIMATE

January 31, 2023

“Ignoring the climate crisis and its risks would mean deviating from the Fed’s congressionally given mandates,” says a new letter. The Fed has been told it cannot remain neutral on the climate crisis, in an open letter sent today by research

Voters Think Rate Hikes Ineffective at Curbing Inflation

December 6, 2022

New report debunks current approach to tackling inflation, proposes new price stability toolkit. Washington D.C.— More than half of American voters think raising interest rates is an ineffective way of curbing inflation, and over two-thirds think the Fed

Federal Reserve Announces Climate Scenario Analysis for Big Banks: Positive Money US Response

September 29, 2022

The Federal Reserve announced today that six of the nation’s largest banks will participate in a pilot climate scenario analysis exercise in 2023, designed to “enhance the ability of supervisors and firms to measure and manage climate-related